We help charter schools simplify and speed up the process surrounding tax-exempt bond financing, real estate acquisition, and construction.

Charter schools serve more than three million students throughout the nation, but they don’t have access to the same financing structures as district schools.

The attorneys at Caritas Law Group can help charter school leaders as they work toward financing the acquisition and improvement of their facilities to:

- Lower or level out their debt service

- Better serve their community

- Attract new student enrollment

What is a tax-exempt bond?

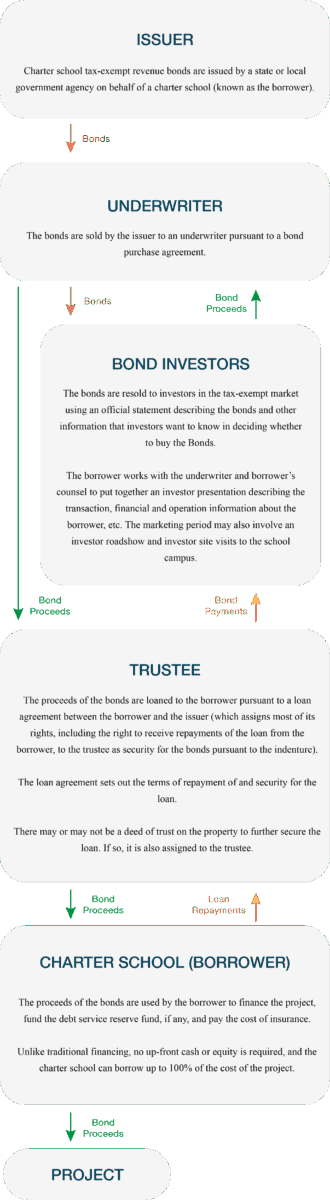

Tax-exempt means that the interest component of bond debt service payments is exempt from federal and sometimes state and local income taxes for the bondholder. Tax-exempt bonds generally offer lower interest rates and longer tenors than most taxable bonds, making them a well-suited and attractive means of financing charter school property acquisition or improvement.

Our experience with tax-exempt bonds

The attorneys at Caritas Law Group have worked on countless publicly offered and privately placed tax-exempt bond transactions throughout the nation.

Since 2016, Ashley I. Spear, Esq. has served as borrower’s counsel or special local counsel on charter school revenue bond issues totaling more than $573 million in Arizona, Nevada, North Carolina, and Florida.

Tax-exempt bond financings often have complicated tax issues related to private use of financed facilities, management and service contracts, and 501(c)(3) tax status. Ellis M. Carter, Esq. has over 26 years’ experience in federal tax issues, which allows us to provide cost-effective, proactive, and strategic legal solutions for tax-related matters.

Our bond services for charter schools

Borrower’s counsel services may include, but are not limited to, the following legal services:

- Coordinating and recommending essential parties to the financing team.

- Preparation of the bond application as required by the issuing authority.

- Preparation of appendices to the limited offering memorandum disclosing the history and background of the Borrower, its board, the project, the real estate transaction, historical, current, and projected enrollment and financials, future plans, faculty and employees, etc.

- Preparation of appendices to the limited offering memorandum summarizing state laws affecting charters schools, primarily with respect to funding and administration thereof.

- Borrower’s counsel legal opinion.

- Borrower’s authorizing and reimbursement corporate resolutions for the bond.

- Preparation or review of certificates or documents customarily prepared by Borrower’s counsel and required to close the transaction successfully.

- Coordination and review of real estate matters, including an environmental study, ALTA survey, appraisal, and title report.

- Preparation of documents relating to the acquisition or construction of charter school facilities, such as a purchase and sale agreement, termination of lease, design and build agreement, etc.

- Review of financial documents pertinent to the offering documents of the transaction.

- Review of and commentary on all documents prepared by other parties and related to the transaction, including but not limited to the bond purchase agreement, loan agreement, promissory note to the issuer with respect to the bonds, closing certificate of the Borrower, tax compliance certificate as to arbitrage and the provisions of Sections 103 and 141-150 of the Internal Revenue Code of 1986, limited offering memorandum, continuing disclosure agreement, indenture, irrevocable pledge and letter of direction to the state treasurer, etc.

- Negotiating all bond documents on behalf of the Borrower.

- Assistance with all investor presentations and marketing efforts of the underwriter, including participation in investor calls and site visits.

What services does your charter school need?

We will determine the appropriate scope of legal services and fees after consultation with you. Our fee is based on the complexity and size of the proposed financing and our experience regarding the level of documentation and counsel that will be required for the nature of your transaction.

The tax-exempt bond process

GET IN TOUCH

Let us help your charter school with the tax-exempt bond process.

FEATURED BLOG POSTS

- What Nonprofits Should Know About Congressional “Subpoenas”

The headlines are alarming. “Senator Demands Documents from Nonprofits Over Protests.” The letters are formal, printed on Senate letterhead, and request sweeping information, donor lists, communications, financial records, all under the implied threat of further action. But here’s what’s often missing from the story: these letters are not subpoenas, and your nonprofit has rights. If your organization

- What the Museum of Communism Teaches Us About the Cost of Losing Civil Society

My visit to the Museum of Communism reminded me that the destruction of freedom does not begin with tanks. It begins with silence, with unchecked power, with the slow erosion of the independent spaces where people gather to build something better.

- Limits of Executive Orders on the Tax-Exempt Status of 501(c) Organizations

In today’s highly politicized environment, executive orders often make headlines. Occasionally, there are claims that executive actions could be used to target nonprofits, particularly those working on environmental issues, supporting migrants, or engaging in international programs. However, it is essential to understand that executive orders cannot revoke or alter the tax-exempt status of organizations recognized